PayPal has revolutionized the way businesses process payments online. Its comprehensive payment gateway provides a secure and reliable platform for processing financial deals. This guide will examine the key aspects of PayPal's payment gateway, helping you to comprehend its functionalities and benefits. From setup to security features and transaction processing, we will cover the essentials you need to know about PayPal's payment gateway.

- Learn about the different types of accounts available on PayPal

- Investigate the process of integrating PayPal into your website

- Analyze the security measures that PayPal implements to protect your business and customer data

- Develop insights into transaction processing, fees, and refund policies

Regardless of you are a small business or an entrepreneur, this guide will provide you with valuable information to leverage the power of PayPal's payment gateway.

Maximize Your Online Store with PayPal Payments

Integrating Pay Pal into your online store can be a game-changer for your business. It's known for its reliability, making it an attractive option for customers. By offering PayPal as a payment method, you boost the overall buying experience, leading to increased sales and customer satisfaction.

- Simplify the checkout process for your customers with PayPal's smooth integration.

- Increase conversions by offering a trusted and popular payment solution.

- Minimize cart abandonment rates by providing a quick checkout experience.

Employ the power of PayPal to develop your online business and lure new customers.

Optimize Your Transactions with PayPal

Integrating PayPal into your platform enables a frictionless and secure checkout experience. Clients can rapidly make payments using their existing PayPal accounts, eliminating the need for them to enter sensitive information multiple times. This integration boosts your customers' delight and lowers cart departure rates, ultimately increasing your sales.

Understanding PayPal Fees and Charges

Navigating the world of online payments can often be challenging, especially when it comes to understanding the various fees and charges associated with platforms like PayPal. However PayPal offers a streamlined way to send and receive money, it's crucial to be aware of the costs involved to avoid any unexpected expenses.

Fees can vary depending on factors such as the type of transaction, the currency used, and the region where the sender and recipient are located. Typical fees include processing charges, which are applied to each transaction, and withdrawal fees, which apply when here you transfer funds from your PayPal account to a bank account.

It's always best to examine PayPal's fee schedule on their website for the most up-to-date information and to calculate the potential costs before making any transactions. Through understanding these fees, you can make more informed decisions about your online payments and avoid any budgetary surprises.

PayPal Security for Your Business

When it comes to e-commerce operations, security is paramount. PayPal understands this and has implemented robust systems to protect both your business and your customers' details. By utilizing PayPal, you can strengthen the protection of your website, lowering the risk of unauthorized activity.

PayPal's commitment to security extends to several key areas. They employ sophisticated encryption technologies to protect sensitive information during transfer. Their anti-fraud systems are constantly monitoring transactions in real-time to detect any suspicious patterns.

Additionally, PayPal offers a range of features to help you manage your account protection. You can set up multi-factor authentication, control transactions by device, and review your account activity for any unexpected actions.

- Select PayPal for its proven track record of safety.

- Utilize multi-factor authentication to strengthen your account security.

- Frequently track your transaction history for any abnormalities.

Best Practices for Using PayPal as a Payment Gateway

When selecting a payment gateway for your online business, PayPal is a well-known option. To enhance its effectiveness and guarantee a seamless checkout experience, consider these best practices. First, integrate strong security measures such as SSL credentials to protect customer data. Clearly present your PayPal link in a prominent location on your website, making it easy for customers to find and complete their transactions. Provide multiple payment options within PayPal, such as credit cards, debit cards, and bank accounts, to accommodate a wider range of customer preferences.

- Continuously track your PayPal account for any suspicious activity or fraudulent transactions.

- Keep current your contact information with PayPal to ensure smooth communication and prompt resolution of any issues.

- Offer excellent customer service by addressing inquiries and concerns promptly and efficiently.

Jennifer Grey Then & Now!

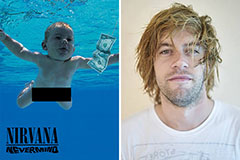

Jennifer Grey Then & Now! Spencer Elden Then & Now!

Spencer Elden Then & Now! Alisan Porter Then & Now!

Alisan Porter Then & Now! Tyra Banks Then & Now!

Tyra Banks Then & Now! Tonya Harding Then & Now!

Tonya Harding Then & Now!